Overview

Features of Yes Bank Education Loan for Abroad

| Feature | Details |

|---|---|

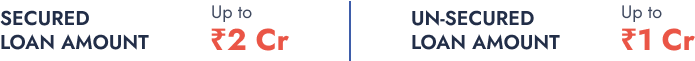

Secured Loan Amount |

Up to 1.25 Cr. |

Unsecured Loan Amount |

|

11.25% - 12.75% |

|

Loan Tenure |

12 Years |

Course + 12 Months |

|

Minimum Co-Applicant Income |

Range Between ₹25,000 - ₹40,000 |

Processing Fee |

1% - 2% of Sanctioned Amount |

Tas Benefits |

Yes; Under section 80e |

Repayment During Moratorium |

Yes; PSI or SI |

Pre Visa Disbursement |

Possible |

Prepayment Charges |

Nil |

Eligibility for Yes Bank Education Loan for Abroad

Understanding the eligibility criteria for a Yes Bank education loan is essential for students looking to fund their higher education. Here, we outline the primary requirements to help you prepare before applying for financial assistance from Yes Bank:

- Indian Citizenship: The applicant must be an Indian national.

- Admission Confirmation: Proof of admission to a recognized educational institution is required.

- Educational Qualifications: The applicant must have completed 10+2 or its equivalent.

- Collateral Requirements: Collateral may be necessary for secured loan amounts.

- Co-Applicant Requirement: Typically, a co-applicant such as a parent, Sibling, and Uncle/Aunt is needed. They also need to meet minimum income requirements to be an effective financial co-applicant.

- University Eligibility: The targetted university must be in the list prepared by Yes Bank and must be ranked in QS Global University Rankings.

- Repayment Capacity: The financial stability of the applicant or co-applicant will be assessed.

Each of these criteria ensures that the applicant is well-prepared to pursue higher education and manage loan repayment effectively. For comprehensive and up-to-date information on eligibility, it's best to consult with Shikshavahini by checking your eligibility.

Documents Required for Yes Bank Education Loan for Abroad

Assembling the required documentation is a vital step in obtaining a Yes Bank education loan, as it aids in the thorough evaluation of your loan application. This process necessitates collecting a complete set of documents for both the applicant (student) and the co-applicant (typically a parent or guardian) to verify their identity, academic credentials, financial stability, and other pertinent details. Below is a simplified table detailing the typical documents needed for both parties.

| Applicant Documents | Co-Applicant Documents |

|---|---|

Admission Letter from the educational institution |

Identity proof (Aadhar Card, PAN Card, etc.) |

Academic Records (10th, 12th certificates, Degree certificates if applicable) |

Address proof (Utility bills, Aadhar Card, etc.) |

Identity Proof (Aadhar Card, Passport, Voter ID) |

Income proof (Salary slips, Income Tax Returns of the past 2-3 years) |

Age Proof (Birth Certificate, Passport) |

Bank Statements (Last 6 months) |

Residence Proof (Aadhar Card, Passport) |

Assets and Liabilities statement |

Scheduled expenses for the course |

Collateral documents (if applicable) |

How to apply for an Education Loan via Shikshavahini?

The process of starting a loan application with Yes Bank is quite simple. All you need to do is follow the below-mentioned steps.

1. Check Eligibility:

Start by visiting the Shikshavahini website or using our loan eligibility form to see if you qualify for a Yes Bank education loan for studying abroad. This assessment will consider factors such as your academic qualifications, admission to a recognized institution abroad, and creditworthiness.

2. Loan Application Processing:

An Education Loan Counselor (ELC) from Shikshavahini will guide you through the loan process and provide a customized document checklist based on your profile. After you submit your application, Yes Bank will process your loan request using the required documents.

3. Documentation Submission & Verification:

Gather and submit all necessary documents from the checklist, including academic and income records. Ensure that all documents are accurate and meet Yes Bank's requirements. The bank will then verify your application, which includes conducting credit checks, reviewing admission details, financials, and other pertinent information.

4. Loan Approval & Disbursal:

Once the verification is complete, you will receive a loan approval notification with the approved amount. If you are satisfied with the terms, you can sign the agreement to finalize the process and have the required funds disbursed.