Overview

Tata Capital, a subsidiary of Tata Sons Limited, was founded in 2007 as the financial services branch of the Tata Group. It operates as a holding company for Tata Capital Financial Services Limited (TCFSL), Tata Securities Limited, and Tata Capital Housing Finance Limited. Headquartered in Mumbai, Tata Capital Limited is a provider of financial and investment services in India, with a network of over 100 branches nationwide. The company offers a range of services including consumer loans, wealth management, commercial finance, and infrastructure finance. As a Non-Banking Financial Company (NBFC), Tata Capital is a solid choice for obtaining an unsecured education loan. It's worth noting that Tata Capital currently does not offer secured loan options. They offer loans only for STEM and Management programs.

Features of Tata Capital Education Loan for Abroad

| Feature | Details |

|---|---|

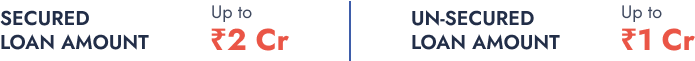

Loan Amount |

US Universities:

Non-US Universities:

|

11.50% - 12.75% |

|

Loan Tenure |

Up to 13 Years |

Processing Fee |

1% + GST |

Repayment During Moratorium |

PSI / SI / EMI |

Minimum Co-Applicant Income |

₹25,000 and above |

Insurance |

Upto 2% of the Loan amount |

Important Points:

- Tata Capital can offer non-collateral loans for aviation courses with immediate EMI options up to 50 Lakh.

- Undergraduate courses may also eligible for loans up to 50 lakhs with immediate EMI options.

- For GRE scores above 315 or GMAT scores above 650, loans are provided based on Platinum category criteria, regardless of the university list.

- For GRE scores between 300-315 or GMAT scores between 600-650, loans are offered based on Gold category criteria, regardless of the university list.

Eligibility for Tata Capital Education Loan for Abroad

To qualify for an education loan, the following eligibility criteria must be met:

- Fixed Obligation to Income Ratio (FOIR) for Financial Co-Applicant: Must be at least 65%.

- Age of Financial Co-Applicant: Must be 60 years or below for salaried individuals, and 65 years or below for self-employed individuals.

- Relationship of Financial Co-Applicant: The co-applicant must be a blood relative.

- Age of Applicant: Must be between 18 and 35 years.

- Credit Score: A CIBIL score of 700+ is required, though exceptions may be made based on the application profile.

- Academic Performance: A minimum of 60% in the last degree or course (10th, 12th, or graduation).

- Indian Citizenship: The applicant must be an Indian national.

- Admission Confirmation: Proof of admission to a recognized educational institution is required.

Documents Required for Tata Capital Education Loan for Abroad

Gathering the necessary documentation is a crucial step in securing a Tata Capital education loan, as it ensures a comprehensive assessment of your loan application. This involves compiling a complete set of documents for both the applicant (student) and the co-applicant (usually a parent or guardian) to verify their identity, academic qualifications, financial stability, and other relevant details. Below is a simplified table outlining the typical documents required for both parties.

Applicant's Documents:

- Identity Proof: PAN card, Passport, Driver’s License, Voter ID card, or any government-issued identification document.

- Education Loan Application Form

- Address Proof: Recent copy of telephone bill, electricity bill, water bill, piped gas bill, driving license, or Aadhaar card.

- Past Academic Records:

- 10th standard mark sheet

- 12th standard mark sheet

- Undergraduate results (semester-wise)

- Entrance Exam Results: e.g., GMAT, GRE, TOEFL, etc.

- Proof of Admission: Admission letter (conditional admission letter is also acceptable).

- Statement of Expenses

Co-Applicant's Documents:

- Identity Proof: PAN card, Passport, Driver’s License, Voter ID card, or any government-issued identification document.

- Address Proof: Recent copy of telephone bill, electricity bill, water bill, piped gas bill, driving license, or Aadhaar card.

- Bank Account Statement: Last 6 months' statement (in case of education loan takeover).

Income Proof for Salaried Co-Applicant/Guarantor:

- Salary Slips: Last 3 months.

- Form 16: Copies from the last 2 years.

- Bank Account Statement: Last 6 months (salary account).

- Statement of Assets & Liabilities: Brief statement from the parent/guardian/other co-borrower.

Income Proof for Self-Employed Co-Applicant/Guarantor:

- Business Address Proof

- IT Returns: Last 2 years (if IT payee).

- TDS Certificate: Form 16A, if applicable.

- Certificate of Qualification: For professionals (e.g., C.A., Doctor).

- Statement of Assets & Liabilities: Brief statement from the parent/guardian/other co-borrower.

- Bank Account Statement: Last 6 months.

How to Apply for an Education Loan via Shikshavahini?

The process of starting a loan application with Tata Capital is straightforward. Follow these steps:

Check Eligibility:

Visit the Shikshavahini website or use their loan eligibility form to see if you qualify for a Tata Capital education loan for studying abroad. This assessment will consider factors such as your academic qualifications, admission to a recognized institution abroad, and creditworthiness.

Loan Application Processing:

An Education Loan Counselor (ELC) from Shikshavahini will guide you through the loan process and provide a customized document checklist based on your profile. After you submit your application, Tata Capital will process your loan request using the required documents.

Documentation Submission & Verification:

Gather and submit all necessary documents from the checklist, including academic and income records. Ensure that all documents are accurate and meet Tata Capital's requirements. The bank will then verify your application, conducting credit checks, and reviewing admission details, financials, and other pertinent information.

Loan Approval & Disbursal:

Once the verification is complete, you will receive a loan approval notification with the approved amount. If you are satisfied with the terms, you can sign the agreement to finalize the process and have the required funds disbursed.